In 2023, the US stock market experienced a remarkable turnaround, bouncing back from the previous year’s bear market – the S&P 500 surged by 24%, nearly recovering all of the losses from 2022. This resurgence was fueled by several factors, including decelerating inflation, better-than-expected corporate earnings, and falling treasury yields. As a result, the market reached near-record highs, with some Wall Street strategists suggesting that the gains could continue into 2024.

While overall market performance was strong, standout performers emerged among the S&P 500 companies. We delve into the top stocks of 2023, showcasing their impressive gains and the factors that contributed to their success. Additionally, we’ll examine the sectors that drove the market’s robust performance and discuss the broader trends that shaped the year.

The Top Stocks of 2023

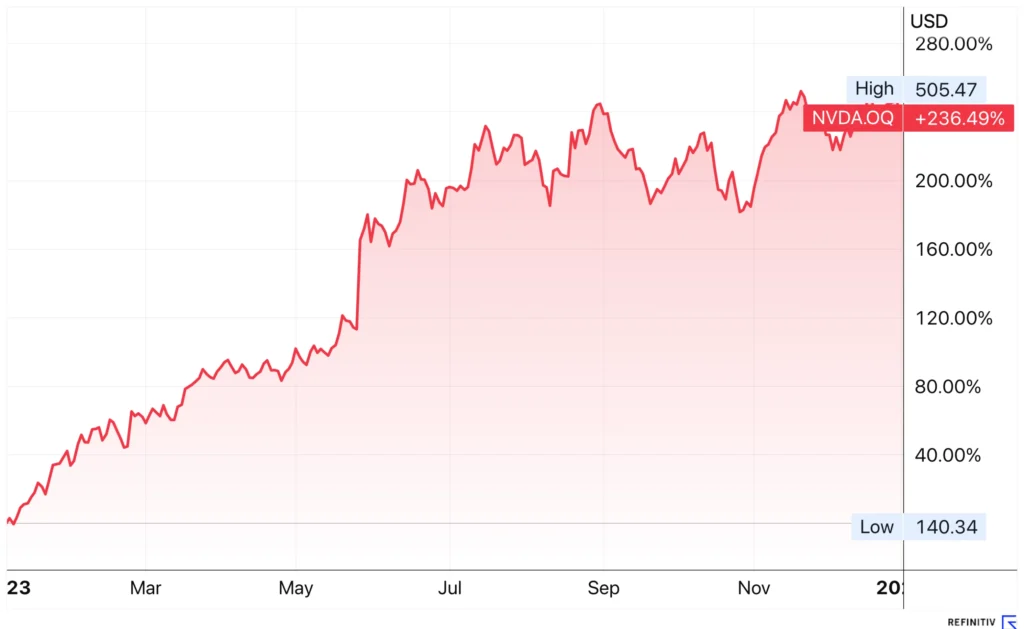

1. Nvidia: Powering the Tech Revolution

Nvidia (NVDA), a leading semiconductor company, emerged as the top-performing stock in the S&P 500 in 2023, delivering an astounding 236% return. Benefiting from the tech resurgence and the explosive growth of artificial intelligence (AI), Nvidia’s graphics processing units (GPUs) are in high demand, particularly from datacenter operators like Amazon, Microsoft, and Alphabet, who are expanding their global operations.

The company’s strong financial performance exceeded even the most optimistic analyst projections. Analysts have increased their full-year earnings per share (EPS) estimates by 21.48% in the past 60 days, with a projected revenue growth rate of 61.5% for the next year. Revenues are anticipated to climb by 53.1% to $90.22 billion.

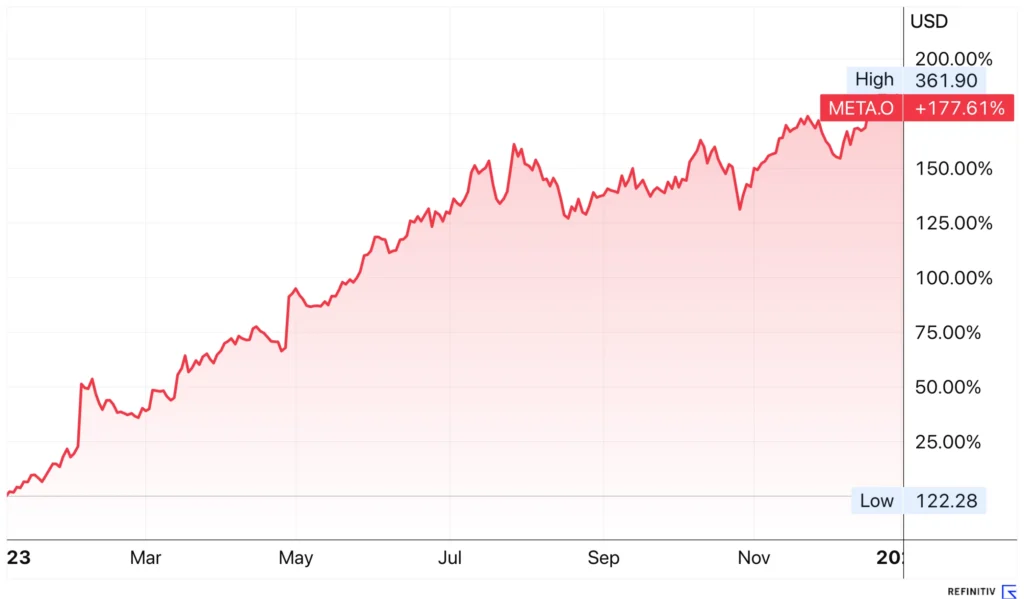

2. Meta Platforms: Leveraging the Power of Social Networking

Meta Platforms (META), formerly known as Facebook, secured the second spot in the top stocks of 2023. Despite earlier concerns about the company’s focus and performance (particularly as CEO Mark Zuckerberg increasingly focused company efforts on Virtual Reality and the Metaverse), increased engagement across popular apps like Instagram, Facebook, WhatsApp, and Messenger drove its growth. The company’s use of AI to recommend content, particularly through its Reels feature, led to increased traffic and advertising revenues.

Meta Platforms consistently exceeded earnings estimates throughout the year, with a trailing four-quarter average earnings surprise of 27.5%. Analysts expect a 22.7% EPS growth to $17.57/share on 13.4% higher revenue growth ($151.37 billion) in the next year.

Meta’s growth came off the back of a disappointing 2022 for the company, with the company embarking on a significant cost-cutting exercise early in 2023 – a big factor in their impressive earnings performance.

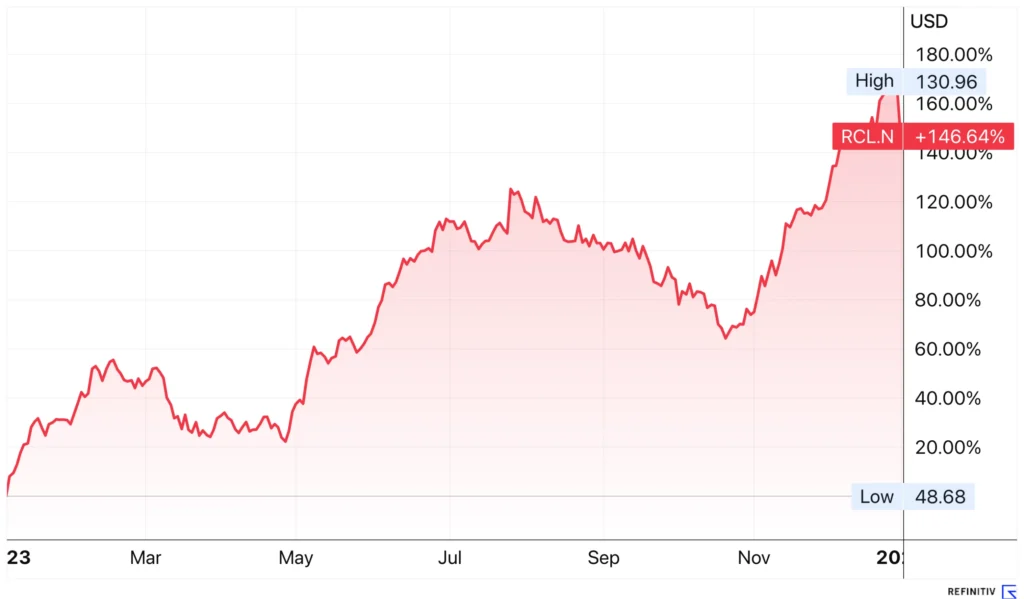

3. Royal Caribbean Cruises: Setting Sail for Success

Rounding out the top three performers is Royal Caribbean Cruises (RCL), benefiting from solid cruising demand and an acceleration in booking volumes. The company’s emphasis on a full fleet resumption and higher pricing has positioned it well for future growth. Technological innovations, such as revamped websites and new vacation packaging capabilities, have also boosted pre-cruise purchases and consumer onboard spending.

In the past 60 days, analysts have revised their EPS estimates for 2024 upwards by 2.59%, signaling robust revenue growth and a projected rate of 38.1%. Revenue is anticipated to surge by 13.7% to $15.86 billion. The stock performance of Royal Caribbean Cruises has soared more than 162% in 2023, a testament to its strong performance and optimistic future outlook.

Sector Performance: Driving the Market’s Growth

The S&P 500 gains in 2023 were propelled by standout performances in technology, communication services, and consumer discretionary sectors leading the charge and contributing the most to the annual gains.

Companies in the technology sector, such as Nvidia and Meta Platforms, were pivotal in the market’s strong performance, with AI adoption playing a significant role in their growth. Communication services firms, including various social media platforms, enjoyed heightened engagement and a boost in advertising revenues.

Meanwhile, the consumer discretionary sector reaped the benefits of robust consumer spending and a high demand for diverse products and services. Defensive sectors such as utilities and consumer staples did not fare as well in 2023, and energy stocks also experienced a slowdown. However, sectors like real estate, industrials, and financials saw a resurgence, particularly in the latter part of the year, as the market rally gained momentum and broader market participation was observed.

The Importance of Diversification

While media coverage often emphasizes the dominance of top stocks within the S&P 500, it’s noteworthy that only one of the top five constituents by index weight ranks among the top three performers of 2023. This underscores the importance of diversification in portfolio management, encouraging investors to adopt an investment strategy that includes a varied selection of stocks across multiple sectors to balance risk and optimize returns.

It’s also worth noting that while the US market over-performed versus expectations, the local New Zealand market barely delivered any growth after strong performance over the last ten years – partially due the local index’s dominance by energy and infrastructure companies, that tend to be more sensitive to higher interest rates.

Diversification is a strategic approach that enables investors to tap into the potential gains from a variety of investment sectors and industries, as well as reduce volatility through allocation to lower risk asset classes such as fixed income and cash. By allocating investments across a diverse range of assets and indexes, investors can tailor their portfolios to their individual needs and goals, and strike a balance between the pursuit of higher long-term returns and the lower short-term movements in value.

Reflecting on a Year of Impressive Gains

The S&P 500 witnessed remarkable stock performance in 2023, with these three companies, along with others such as Apple, Microsoft, Visa, and Tesla, delivering exceptional growth. Industry factors such as the tech resurgence, widespread AI adoption, increased activity on social media platforms, and strong consumer spending were key drivers of the market’s impressive performance.

Investors eyeing the horizon of 2024 should be mindful of 2023’s performance in the face of low expectations, while keeping aware of factors that might affect this years returns – such as where interest rates move to next, how economic growth delivers as inflation subsides, and the potential for broader geopolitic events to create short-term volatility – or buying opportunities. Embracing diversification, considered asset allocation, and an awareness of emerging trends and technologies are pivotal for effective market navigation and positioning portfolios to thrive.

Ready to get in touch?

Get in touch now for a free no-obligation chat about how we can support you and your investment needs.